Ellen Järnefelt

Digital energy tech startups are at the center of solving the 3 Ds of the energy transition. We did some research and interviews with industry experts like to get an overview of where the sector stands, and where it’s headed.

In the wake of COP26 the spotlight is on climate change, and the energy sector is central in finding the solutions. The industry is driven by the Three Ds: decarbonization, decentralization, and digitization. The latter’s role is becoming increasingly central in solving the complex problems in the former two – and startups and VCs are playing a leading role. We conducted research on the digitized vertical, and talked to Helen Ventures’ Terhi Vapola and other industry experts to get a better hold of where the industry is right now, and where it’s headed. While as Vapola says there are no silver bullets, the digital vertical plays a pivotal role in enabling other solutions at scale.

European Energy market overall & comparison to whole market

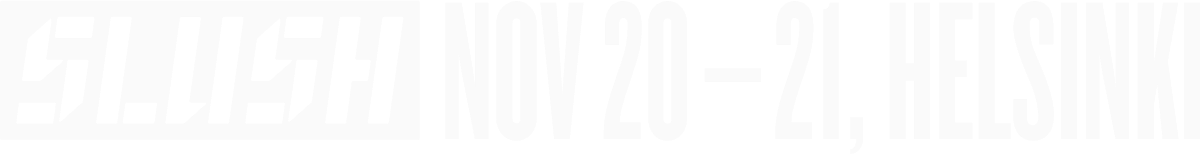

Investments in energy startups have been on the rise in recent years. As funding grew fourfold in 2016-2021, energy investments grew at an even faster pace than the general European market.

“It’s clear that the main reason for this development is the ongoing climate crisis, and the crucial role the energy sector is playing in solving it”, says Helen Ventures’ Vice President, Head, and Founder Terhi Vapola.

2021 has been a significant year for Europe’s climate future. The European Union has ambitious targets: The EU’s upcoming “Fit for 55” -package, to be enacted this year, sets the target of at least 55% emission reduction for 2030 compared to 1990, and net zero by 2050. Whether or not we’ll get to our goals is largely a matter of whether certain investments can be made in time. Where do startups come in?

“Startups bring in new technologies, innovate and implement in a more agile manner than the general industry, and take risks”, says Helen Ventures’ Vapola. “This sits perfectly at the current energy market transformation, where finding new solutions is a must-have, not a nice-to-have. The current digitization of the energy industry is something startups are generally experts in.”

The Three Ds powering the energy industry’s development – decarbonization, decentralization and digitization

Trend 1: Decarbonization

As ‘net zero’ is becoming a universal goal, companies are ready to invest in the careful inspection of their carbon footprints, with founders and VCs hoping to cash in on these goals. This offers many opportunities, varying from energy management and source tracking to carbon footprint measuring software, and startups are acquiring funding left and right.

Decarbonization is present not just in how companies do their business or how consumers behave, but also in the energy sources used, as renewables are increasing their market share at an accelerating speed.

“An important notion is that renewables are actually also very economical – solar power is amongst the cheapest ways of generating energy in Europe, and so is wind power. It’s not only good for the environment, but also good business,” says Vapola.

This brings major climate victories, but also a wide range of new optimization challenges.

“With rising pressure on decarbonization and efficiency, we see a strong role for AI technologies to help assess future scenarios, make the right trade-offs and above all, help manage the energy systems that will be more complex and integrated”, says Herve Huisman, CEO and Founder of Gradyent, the AI-powered energy analytics solution.

Trend 2: Decentralization

The second prominent trend of decentralization is mainly driven by a mix of increasing demand, climate targets and the need to cut costs and secure energy supply. As the production of energy is decentralizing, energy storage is in the beginning of a similar path. In addition to larger-scale battery powerhouses like the Swedish Northvolt, storage capacity is being searched from increasingly unexpected places. For example, many EV charging platforms like Virta Ltd. are pioneering the so-called V2G, vehicle-to-grid, that enables energy to be pushed back to the power grid from the battery of an electric car to leverage the excess storage capacity in EVs.

Due to the currently limited yet high-cost energy storage possibilities, energy has always been generated on a level equal to usage. This balance was previously easier to optimize, as the sources were simple and few. “It’s no longer one or a few providers whose generation is easy to optimize, but the grid is constantly becoming more scattered and hence more complicated,” Vapola elaborates.

This has clear implications: “In our sector [of district heating] we see that 5-10 years ago, the energy systems were simple enough to be managed with relatively simple linear simulation and control systems”, Gradyent’s Huisman describes. “There were applications of AI, but they were still in the space of academia and R&D. Today, AI is getting much higher on the agenda of the energy players who are looking for real benefit and impact.”

As the share of renewables increases, factors like the weather have stepped into the equation. This creates forecasting and optimization problems, and the need for AI tools is blowing up – which is where digitization comes in.

Trend 3: Digitization

As the problems to be solved are getting more complex and the evolving technology is offering new opportunities, platform businesses are emerging in droves. There are optimization and forecasting needs, but also a need to connect suppliers and end-users – translating into potential for digitization.

Even though energy software startups are constantly finding new growth pockets within existing energy niches, the slowly-moving energy industry sets the boundaries to where digital products can go.

“Still, there are technologies that are less dependent on existing infra that mostly operate on the consumer interface, and they’re increasing as they’re generally more scalable,” Vapola notes.

The digital solutions of today and tomorrow will be crucial in managing the new complex equations and making sustainable energy accessible and affordable. Energy’s digital segments – SaaS, marketplace and ecommerce business models are changing the concept of energy products. Therefore we took a look at these three digital energy tech verticals in Dealroom data, to break down what is happening in digital energy tech, who are the protagonists, and how are startups solving these problems.

WHAT are the problems solved in digital energy tech?

The emerging digital market is climbing at an accelerating speed

The SaaS, marketplace, and e-commerce verticals within the energy industry have been growing at a stellar speed with a 47,0% compound annual growth rate (CAGR), compared to the 34,5% CAGR of the general energy market.

Top industries within digital energy – size and growth

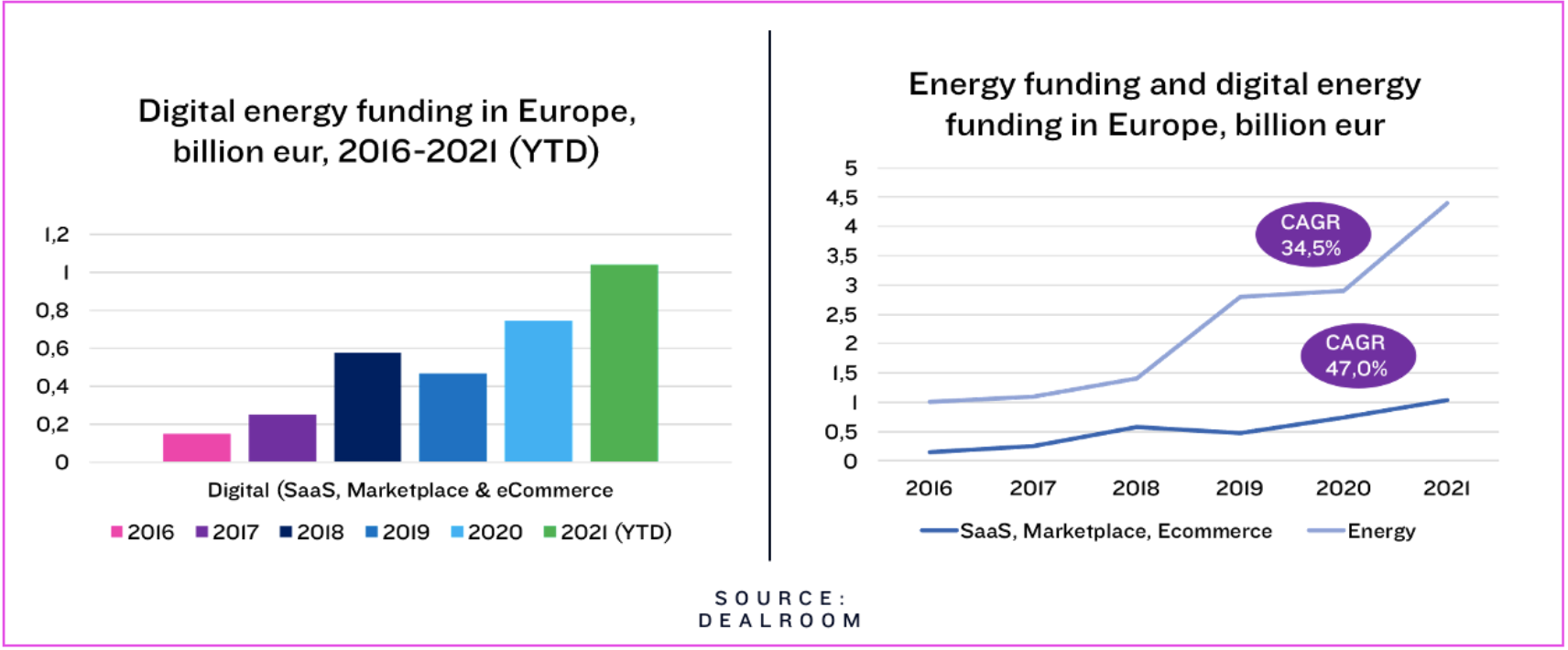

Within digital energy, the direction of the funding between 2016 and 2021 is clear: clean energy, energy providers, and energy efficiency bagged 92,8% of the total funding, with the largest sub-segment being clean energy with €2,7 billion of funding.

“As the grid diversifies and optimizing is constantly more difficult, intelligent, AI-powered software is critical,” Vapola says.

Let’s look at five prominent examples of top sub-industries in digital energy, and the players in them to understand where the industry is headed.

1. Flexible solutions for energy assets and the optimization of renewables

Many startups have emerged with an offering that enables more efficient energy generation or energy storage utilization. An example that falls into both clean energy and energy efficiency categories, Sympower aims to unlock their customers’ energy potential by different flexible solutions.

Utilizing the grid’s unbalances, Sympower’s Power Flex -product enables tapping into new revenues by participating in balancing markets, where the users’ assets become part of the flexibility mix in different balancing pools. Based on the user’s assets and availability, they are activated when the grid operator needs to balance the grid. Imbalances between the forecasted and realized energy generation and demand can cause unexpected costs.

This well illustrates an energy software’s value proposition – using your energy-related assets more economically and efficiently, and unlocking their full potential. The significance of this rises along with the share of renewables.

“The thing with renewables’ software solutions is that we have companies specialized in wind, companies specialized in solar power, et cetera – the production technology is different,” Vapola highlights. “From a client perspective, they could converge as one O&M system and be on the same site – the need for comprehensive solutions is increasing.”

2. Optimizing energy trading

As the share of renewables is growing at accelerating speed, the capricious supply has large implications on the market, and volatility is building up.

To optimize the trading, startups like Enspired are offering fast and data-driven energy trading within the energy efficiency segment. The Vienna-based startup uses self-learning models to execute fast trading strategies, and provides straight-forward access to intraday markets.

3. Energy providers – self-generation and smart grids

With a 111,3% cumulative annual growth rate in 2016-2021, energy providers were the fastest-growing sub-industry of digital energy alongside clean energy.

In addition to controlling the sources and using energy sparingly, self-generation is booming like never before – photovoltaic systems (PVs) are being installed into private households and communities in increasing amounts. The German Zolar installs PVs that can be planned and customized online by the consumer. The single-source self-generation provider bagged €35 million in Series B funding in March 2021, a round led by Energy Impact Partners, and another €20 million in November 2021.

The German Sonnen offers a combination of a PV system and the “sonnenBatterie” to use as storage. The company’s mission is to cover around 75% of a household’s yearly energy requirement with clean, self-generated energy.

4. Supporting the grid

The integration of increasing amounts of solar and wind power isn’t easy on distribution grids. As the energy transition progresses, grid processes need to be more digitized and automated, yet the current IT structures are often unclear, and many grid operators’ processes require a lot of manual work.

The grid faces challenges not just with carrying the energy, but also with the infrastructure. LiveEO uses satellite technology to monitor large infrastructure networks for external threats. “Using AI, we translate raw satellite data into actionable work orders, helping grid operators make their maintenance operations more efficient and sustainable”, describes Andreas Naujoks from LiveEO.

“For the most part, our monitoring solutions help prevent danger and mitigate risks before damage occurs – for example, trees falling into power lines pose a great threat to electrical infrastructure grids and can lead to outages and even wildfires.”

5. The e-mobility boom

Within energy efficiency, different EV charging operators and platforms have started to acquire a larger market share. When moving to electricity-powered transportation, there are many bottlenecks – charging points and vehicles’ structures.

Virta Ltd’s Director of Energy Services Juha Karppinen sees many significant benefits in electricizing transportation: “The energy efficiency of electricity transmission, electrochemical batteries, and electric drivetrains are higher than with any competing fuel solution,” Karppinen describes. The technologies also benefit from existing infrastructure: “Compared to other alternative technologies, such as hydrogen and fuel cells, e-mobility benefits from the pre-existing electric infrastructure for energy transport and distribution.”

An important theme within eMobility is the V2G technology, which is also key in the transition away from fossil fuels. “The transition in global energy production to zero-carbon variable renewable energy sources, such as wind and solar, requires additional flexibility in energy consumption to withhold the power balance,” Karppinen notes. “The charging of electric vehicles is a great globally increasing source of flexibility for the energy system. In essence, we need the battery capacity of electric vehicles to get rid of fossil electricity generation.”

Biggest rounds in 2020-2021

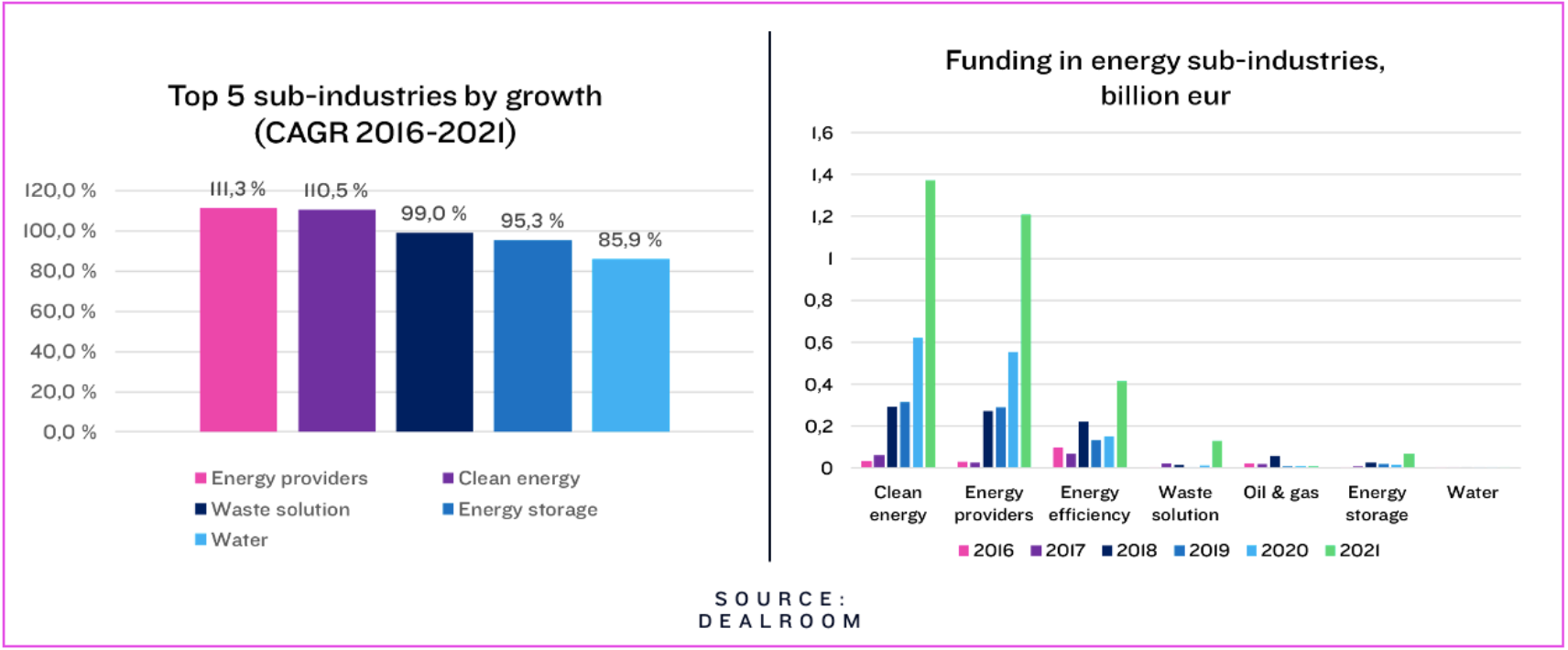

Another indicator of what’s happening in the digital energy tech space is where the money is flowing, i.e., who is raising the biggest rounds of funding. Who are the VCs betting on? We took a look at the biggest rounds of 2020 and 2021 within energy SaaS, marketplace and ecommerce.

In 2020, The UK-based clean energy supplier Octopus Energy secured two massive rounds; both a €360 million late VC round from the large Australian energy provider Origin Energy, and €182 million in growth equity from Tokyo Gas, the Japanese natural gas provider. But that was only the beginning – in September 2021, Octopus followed these triumphant rounds with a humbling €545 million growth equity investment from Generation Investment Management.

Another marketplace operator within smart energy, Tibber offers a platform that buys the cheapest electricity at any point of the day and offers real-time analytics on energy usage. Tibber raised a €27,5 million Series B round in November, and is backed by investors like the San Francisco-based Founders Fund, known for their early investments in SpaceX, Spotify, Facebook and Airbnb.

“Round sizes have clearly gotten a lot larger; what a while ago was an average Series A amount is now more of a Seed amount” Vapola says. “It makes sense especially in the B2C front, where capital is needed in large amounts for customer traction and acquiring the share of mind.”

Other champions were Tado, Zolar, and the Finnish Virta. With its €30M early VC round in April 2021, Virta continues its EV revolution. Right now, Virta is Europe’s fastest-growing eMobility platform, and the added funding will be used to accelerate its growth and expansion into new markets.

Looking at the largest rounds of 2020 and 2021 within digital energy, the clearest takeaway is the upturn of B2C-products. As energy, both hardware and software, are largely dependent on the movements of states and large corporations, startups have traditionally not had much access to end customers. As the grid diversifies and digitizes, new consumer business pockets are opening up. B2C-products can, at their best, have enormous scaling potential compared to B2Bs that are largely dependent on existing infrastructure and its progress.

WHO are the most notable startups and VCs in the industry?

What do investors and founders in the digital energy tech sector look like?

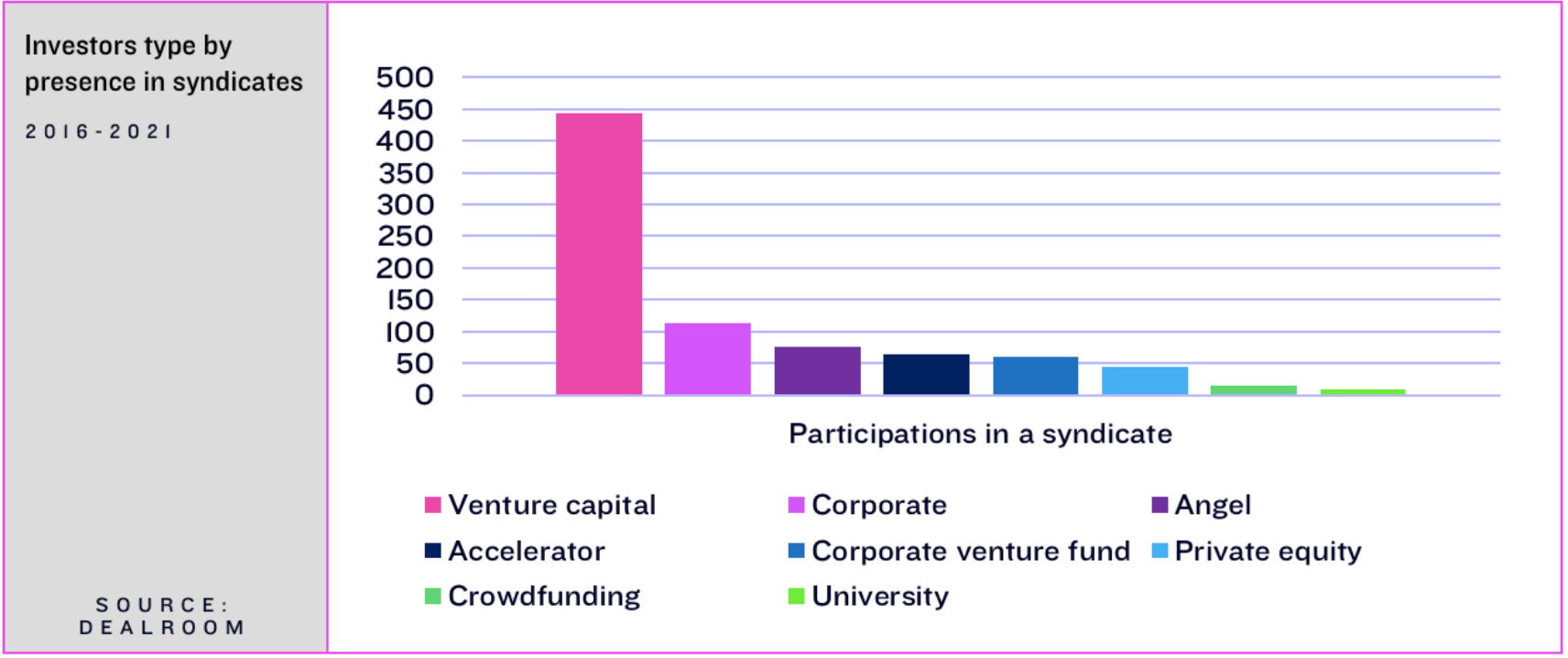

Investor types by syndicate presence

Most common investors within European SaaS, marketplace and ecommerce startups are VCs – in terms of syndicate presence, they represent over four times the amount of the second largest investor group, corporates. “Provided a VC has a strong track record in the sector, it should be able to add a lot of value in market traction, partnerships, organizational development, fundraising and the exit process”, says Emerald Technology Ventures’ Managing Partner Gina Domanig.

The VC skillset is emphasized in a technologically complex industry such as energy tech: “As in energy, both the industry and the market are very complex, and VCs have to have extensive domain expertise in both to really create value,” Helen Ventures’ Vapola elaborates.

Corporations are also an important investor group, as many startups offer technologies that are complementary to their core product or offer benefits of scale.

“The significance and presence of corporate investors is definitely enhanced in the energy industry,” Vapola describes. “This is driven by the market’s complexity.”

When it comes to software, many startups might have products that can prove to be extremely valuable for larger corporates: a massive benefit to Origin Energy from its Octopus Energy investment has been its exclusive licence to deploy Octopus’ customer management platform Kraken, that Origin says could bring operational cost savings of €130 million – annually.

Next up in volume, accelerators and angels play a crucial part in molding the startup’s trajectory. “Accelerators are important particularly to influence the organizational development and set the companies up for commercial and fundraising success”, says Domanig.

At best, angels can provide more attention: “Angels often give more hands-on time and effort to the founders. This is highlighted in energy tech where founders are often very technical, and can truly benefit from an angel that can provide expertise especially in pricing, commercializing and building traction” Vapola describes.

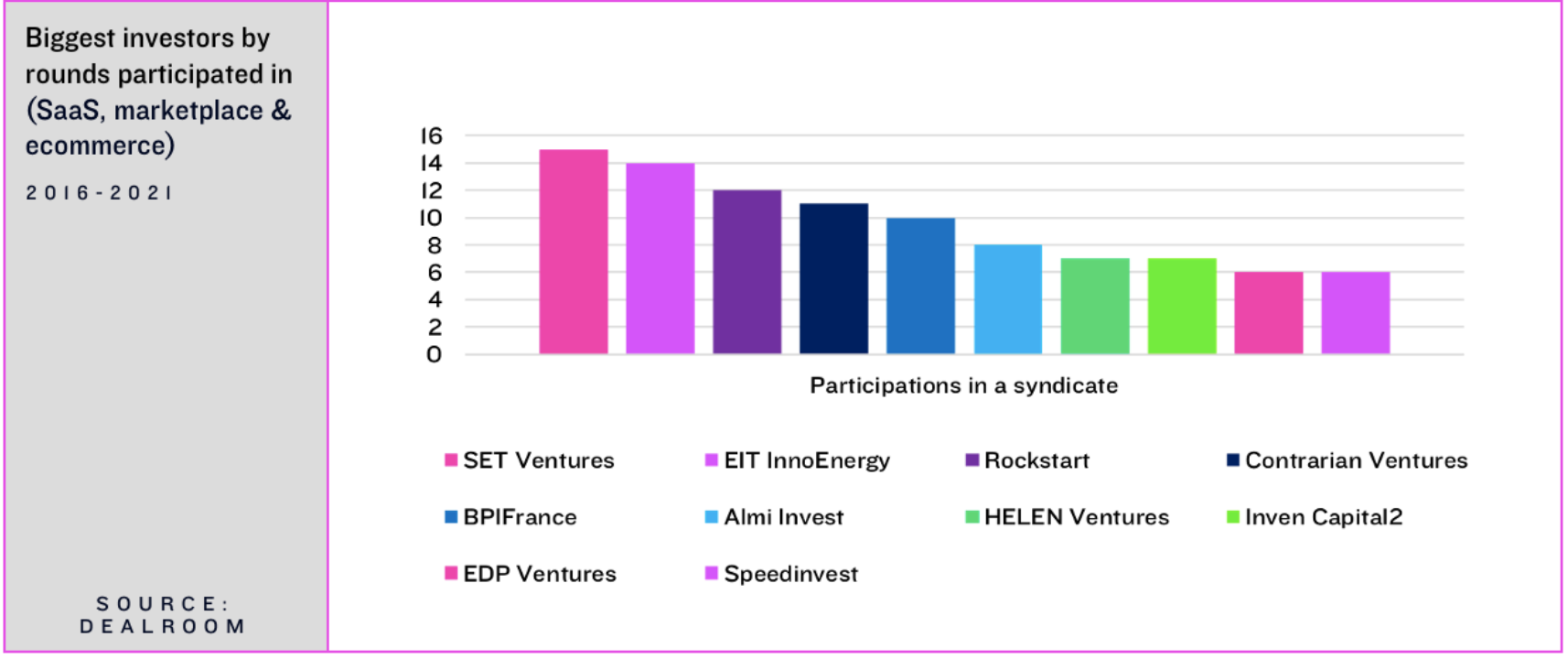

Biggest investors by rounds participated in

VC’s are the most common investor type – but who, in particular, invests in energy within digital energy tech?

- With its 15 rounds in digital energy tech in years 2016-2021, SET Ventures has been the busiest. Focusing on energy transition, SET Ventures mentions smart energy system solutions as their investment priority: business cases involving intelligent software, combined with hardware components. They invest in startups through their life cycles – rounds participated in 2020 and 2021 include a €12 million late VC round for the German IoT startup GreenCom in 2020 and a €2,5 million Series A round for the Spanish autonomous wind turbine operator Green Eagle Solutions in 2021.

- Another large energy-focused investor is the European Institute of Innovation & Technology’s EIT InnoEnergy, which is on a mission to help decarbonize Europe by 2050 by their three industrial alliances: battery storage, green hydrogen and solar photovoltaics. For example, EIT InnoEnergy took part in the Energiency’s €4,5 million Series A in March 2020 and Enervalis’ €2,8 million Series A in August 2020. Having participated in 14 European digital energy tech startup funding rounds over years 2016-2021, it has been the second most active investor.

- With a wider investment scope in terms of industries, Rockstart is a domain-focused Amsterdam-based accelerator-VC. They also have a follow-on growth funding to boost the best startups in four domains: Energy, Health, AgriFood and Emerging Technologies. In the observed years, Rockstart participated in the grid operation automation expert Sympower’s €5,2 million Series B round in 2021, and the windmill blade monitoring and analyzing startup Fibersail’s €0,35 million seed round in 2019 among its total of 12 investments.

- An early-stage sustainable energy transition -focused VC, Contrarian Ventures has also had a busy couple of years. With 11 investments in 2016-2021, such as FuseBox, Inion and ELIQ, Contrarian is heavy on clean energy and energy efficiency.

- Helen Ventures is a newcomer in the digital energy investment space, starting operations at the beginning of 2020. Moving quickly, its experienced investment team has already secured a portfolio of 7 digital energy startups. These include eMobility powerhouse Virta, satellite-based infrastructure monitoring company LiveEO, and the latest addition eMobility customer loyalty and engagement provider &Charge.

Founders – whose companies are they investing in?

Academic background

Compared to average backgrounds of European startups, digital energy tech’s founders are a more binary bunch when it comes to academic backgrounds.

70,5% of digital energy tech founders have a bachelor’s degree – a share much higher than all startups’ average 55,6%. The share of even higher education is likewise larger than the startup average: 7,4% have an MBA, and 7,4% hold a PhD, compared to all startups’ founders, of which only 2,5% hold an MBA and just 2,3% have a PhD.

Serial founders

Serial founders’ accrued skills, relationships and insights are likely to bring clear advantages. However, consistent with the industry’s complexity and slow cycles, it seems that digital energy tech founders are not usually serial entrepreneurs: as much as 85,2% are first-time founders. Since founding an energy-related startup often requires deep technical knowledge, most founders tend to enter from the industry or other STEM-professions.

“This is a big problem, as most energy tech startups are B2B businesses, and industry experience and a strong network definitely increase the probability of success,” says Emerald’s Domanig.

Is there something the ecosystem could do?

Domanig has a few ideas: “Specific support mechanisms including incubation and acceleration in addition to financing services would be helpful. Also, tech transfer departments of technologically oriented academic institutions and angel networks should encourage young founder teams to add experienced industry executives to their founding teams before they get funding.”

The small number of serial founders has multiple root causes. On the one hand, the founders might work longer in the industry to accrue their technical knowledge before starting on their own, and on the other hand, the road to proof of concept, MVP or a pilot might take longer with more complex products.

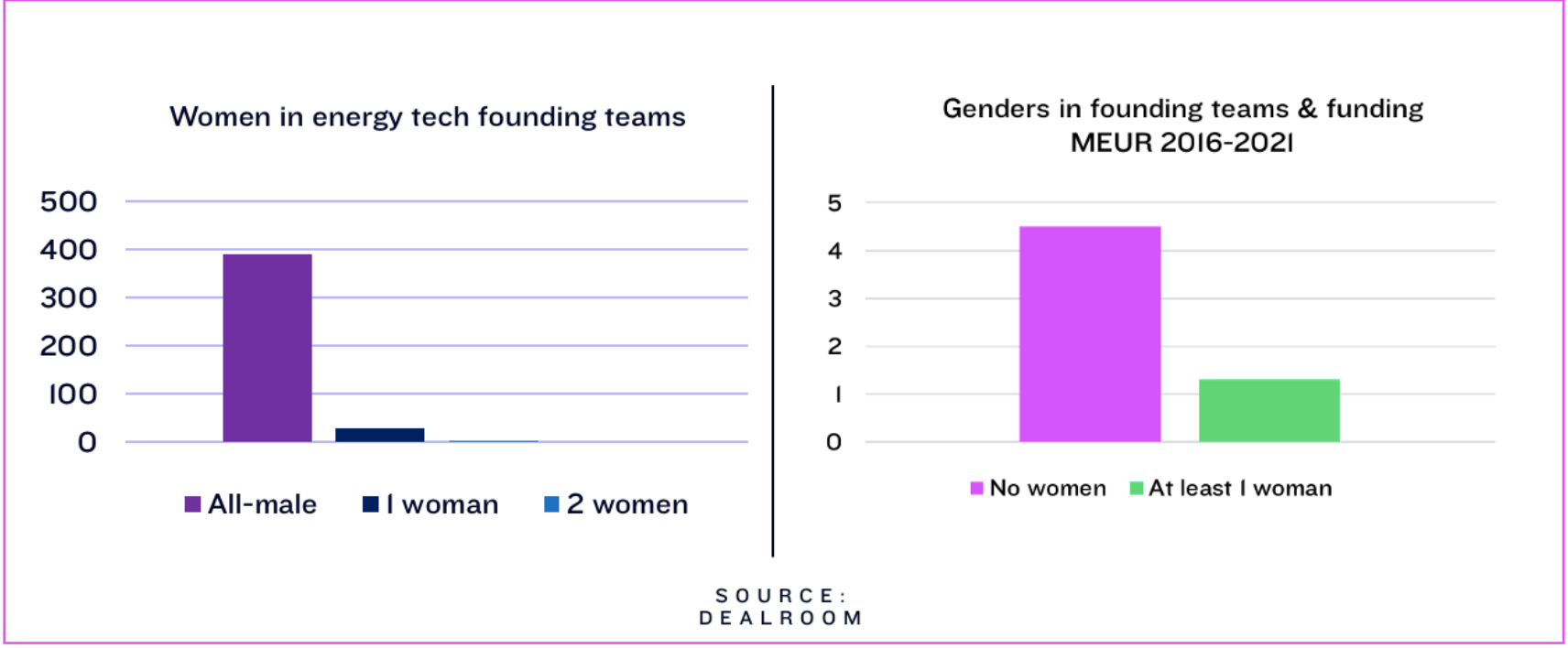

Gender

Energy is still one of the least gender diverse industries. Women are listed in just 11% of the applications for patent classes closely associated with the energy sector, and 15% for climate change mitigation technologies. In Dealroom data on digital energy tech startups, 93% of the founding teams were all-male. How does this look from a VC-perspective?

“Unfortunately, the percentage of investment opportunities that we see with female founders is very, very small. I think it’s the combination of the sector – industrial tech – and entrepreneurship”, Emerald’s Domanig says.

On EU level, only 32% of STEM Bachelor’s graduates and 36% of Master’s were female. When moving towards founding a startup, the women in the already quite male-dominated pool of experts face a rougher-than-average start: shown by a 2014 Harvard study, investors preferred pitches presented by male entrepreneurs compared to pitches made by female entrepreneurs, even when the content of the pitch is the same. Our analysis with Dealroom data tells a similar story: between 2016 and 2021, digital energy tech startups with a founding team with at least 1 woman acquired 71,1% less total funding than all-male teams.

Helen Ventures’ Vapola also thinks that when tackling these intangible, limiting factors, it’s essential to provide support right from the start: “I think it’s important to provide sparring already in the beginning, when fundraising is not necessarily relevant yet – to give time and coaching”.

“Not to mention the investor side. It’s crucial to get more women to the VC side, too, as many nuances might get through better.”

HOW are digital energy tech problems being solved?

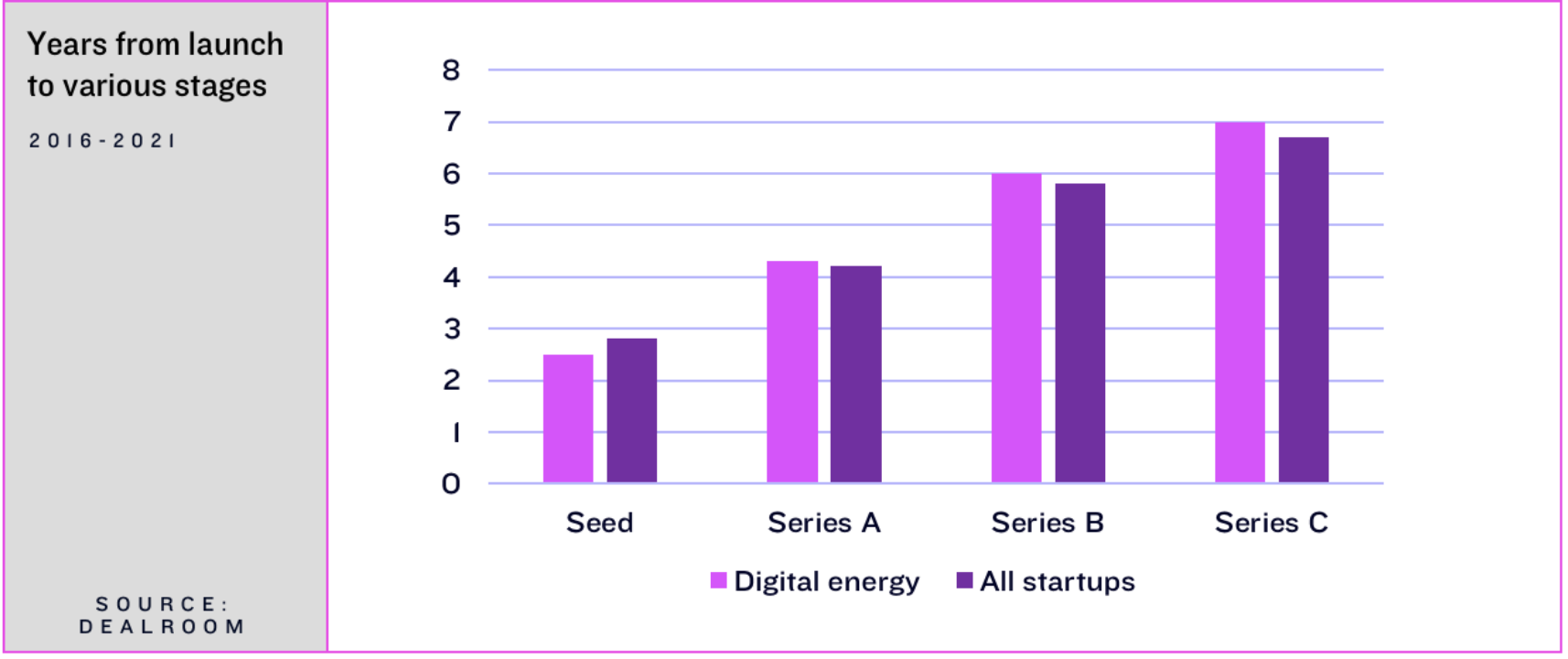

Go big or go home: longer cycles, smaller tickets, and big winners

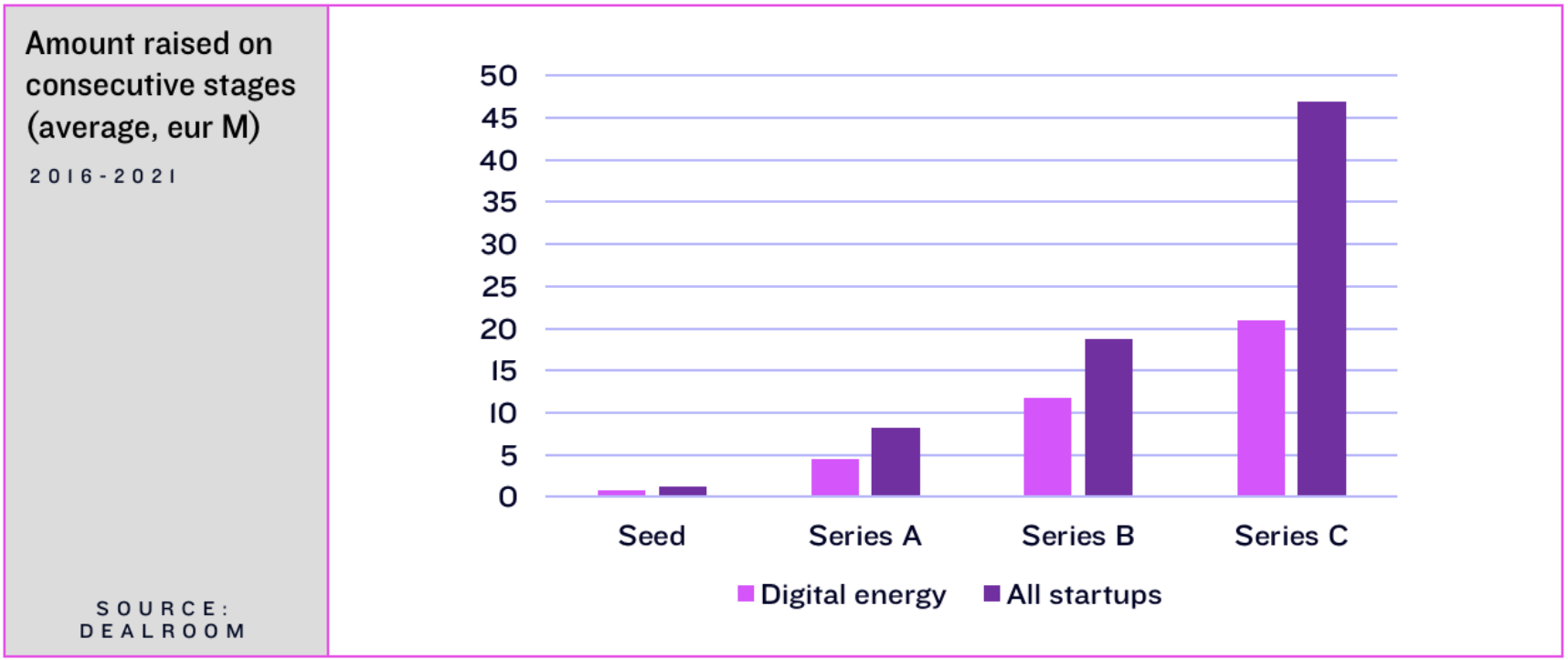

Longer cycles. When it comes to VC-funding, digital energy startups raise funding with slightly longer cycles. Looking at rounds from Seed to Series C, compared to digital verticals within energy, an average European startup is slightly quicker to bag VC-funding.

Why is this the case? First of all, the higher level of complexity of products within digital energy tech means that the development and go-to-market cycles are longer.

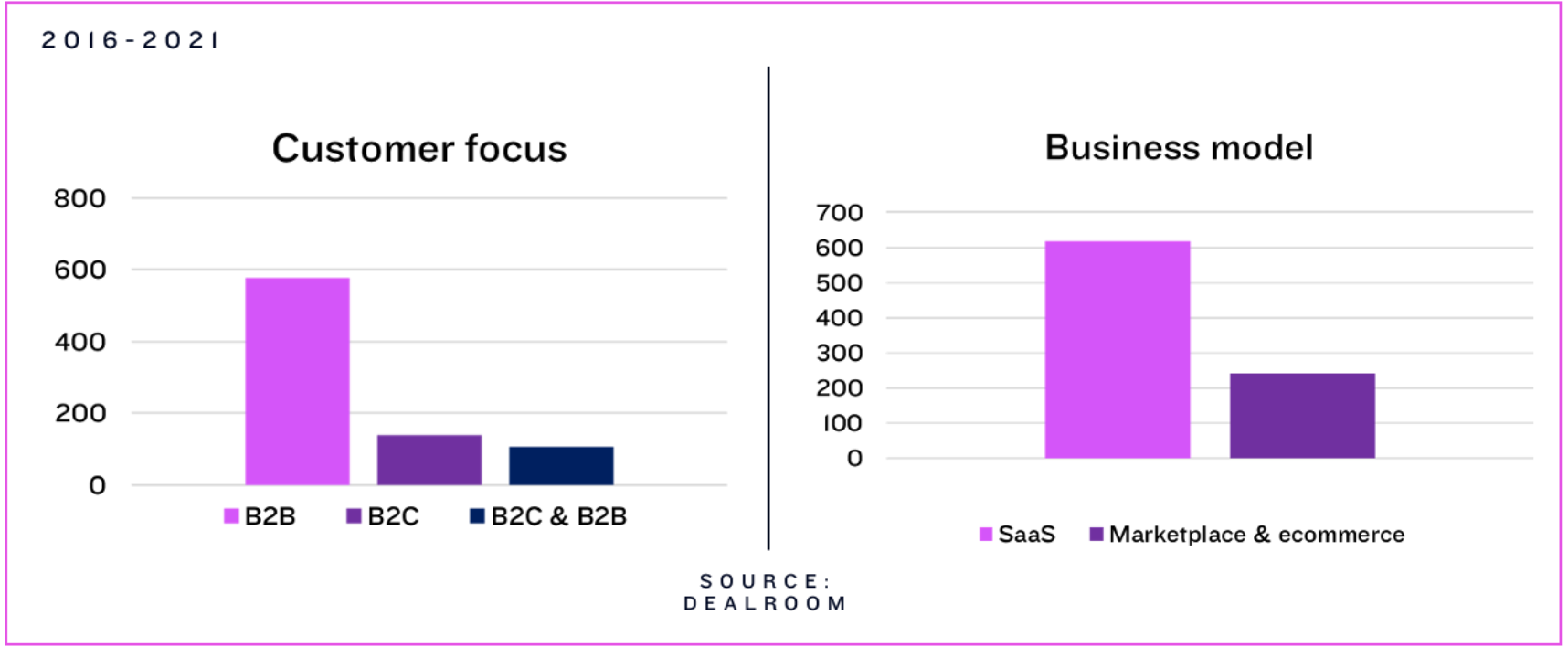

Secondly, company type also has its implications: B2B operators compose over 80% of our digital energy tech peer group, and the heavy B2B composition ties the digital market to the industry and its movements more than in industries with a higher B2C focus.

A third hindrance is the tight web of regulation and rules energy firms operate in; whether these are on safety, energy mix, international treaties, consumer laws and waste disposal. This has made the energy industry to be a risk-averse and cautious client for software providers.

“A lot of this might be taking a turn in the future, as energy generation is decentralizing, and renewable generation is constantly built quicker,” Vapola adds.

Smaller tickets. Consistent with the longer investment cycles, digital energy firms also get more moderate tickets than an average European startup, and the difference increases as the rounds progress. With a €0,4 million difference in average Seed round size, digital energy startups’ funding grows slower than the average, and at Series C, an average startup is already looking at an investment over twice as much as an average digital energy tech startup’s.

This should arise from similar reasons as the longer cycles – capital intense, slowly moving underlying business. Digital energy startups are also working with crucial operation monitoring or planning; this means they’re likely to have to meet a higher ‘bar of proof’ to demonstrate that they’re suitable to integrate into these complex operations.

A Fast track for the fittest

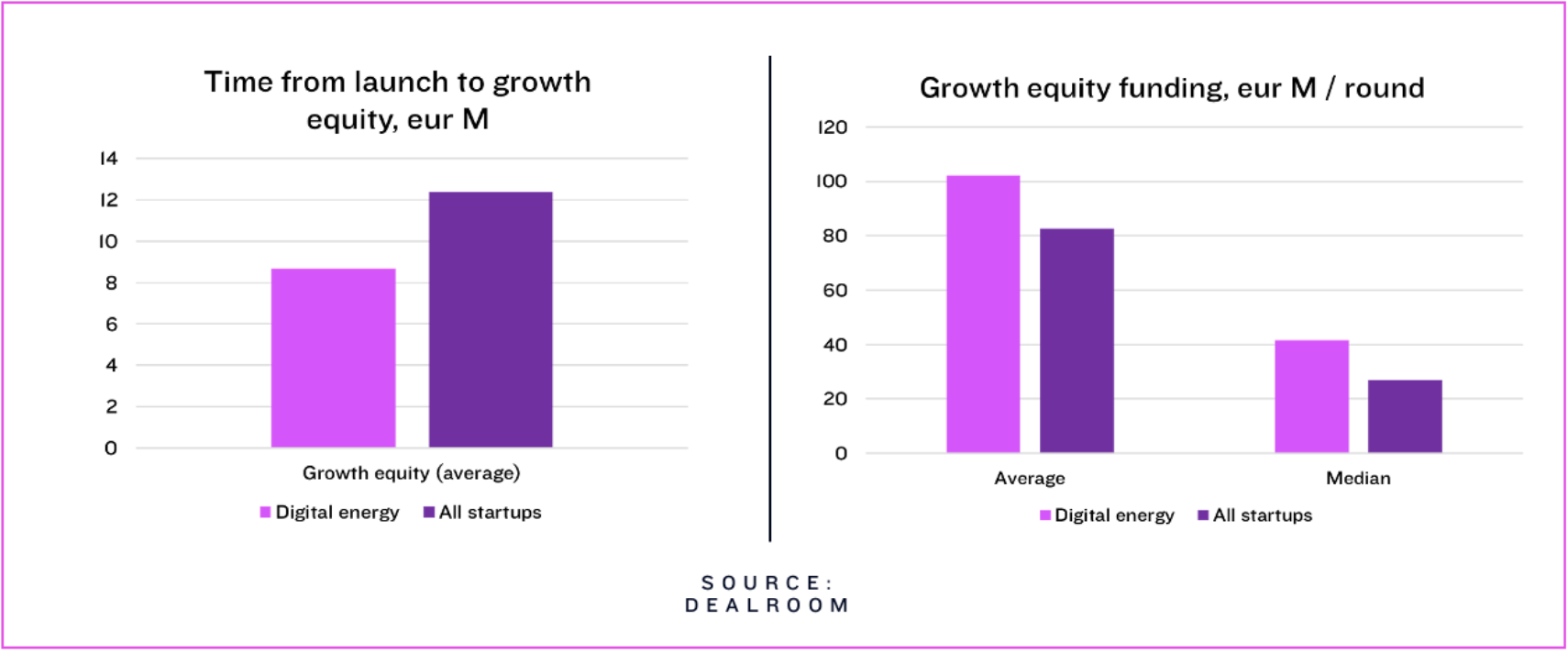

Even though energy startups struggle to get VC-funding on average, there seems to be a fast track for the fittest. For the startups that get scale-up capital we can see that an average scaling-phase energy startup gets its first growth equity round a bit over 8 years after its launch, whereas the same number for an average startup would be over 12 years.

On the B2B front, it’s challenging for a startup to 1) get the digital product totally right and 2) the customers (currently, mostly industrial energy companies) require strong evidence of performance due to their higher risks. Consequently, those first wins might have a more exponential impact on the startups’ funding trajectory than in other industries. If the product clicks, it clicks.

So, they’re quicker to scale – but what’s the volume?

Looking at average growth equity round amounts, energy startups also seem to acquire far more capital than other startups – 23,6 % more, to be specific. Combining this with the lagging VC-funding, it seems that the digital energy industry is quite polarized in terms of both fundraising speed and size: if you make it, you make it big and you make it fast.

Business models & customer focus

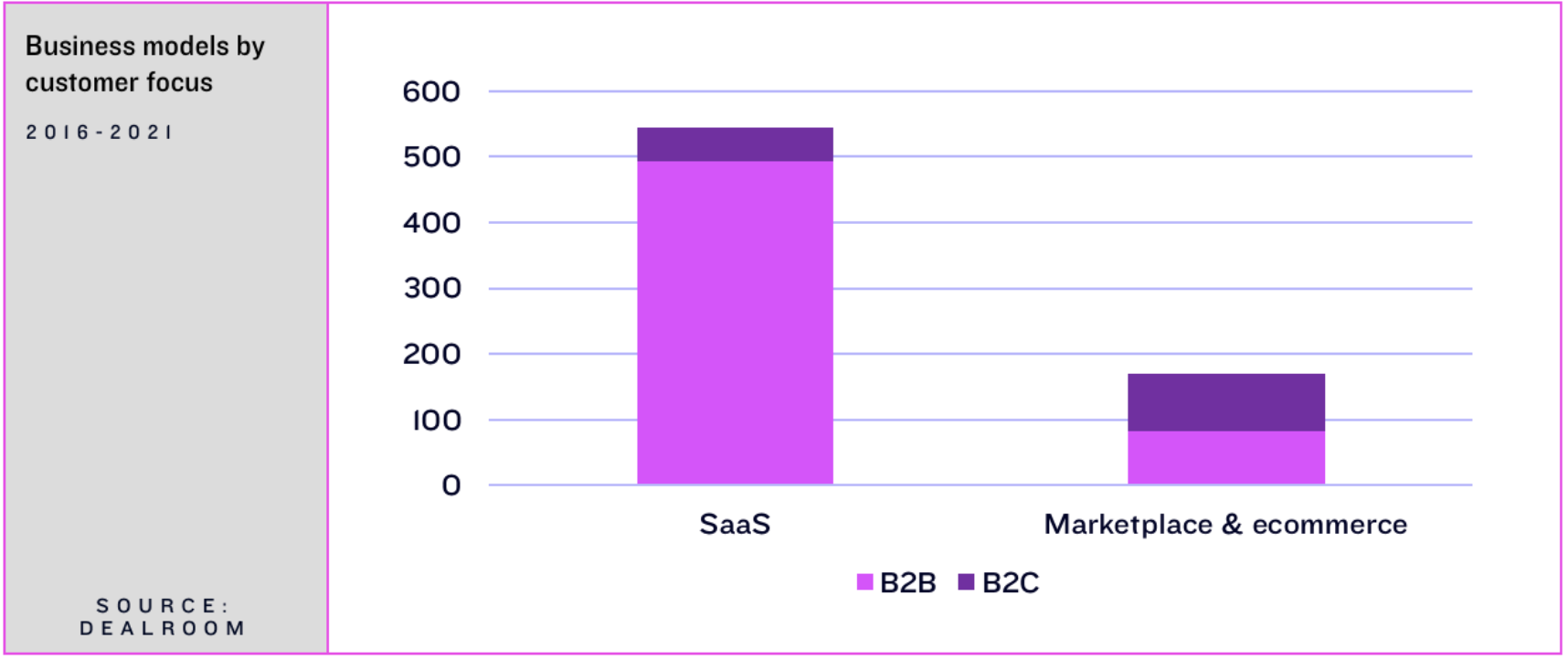

When it comes to digital energy startups, they primarily offer software – SaaS firms composed 71,9% of the firms founded after 2010. Within energy, the SaaS-category contains mostly analytics, monitoring, optimizing, and general AI or IoT; in the energy tech space this translates to grid monitoring, energy optimizing, smart building applications, data analytics, and industrial IoT. Marketplace & ecommerce is a more defined category with space for a limited number of players, but also one that has been on the rise due to the B2C boom.

As energy has long been a CAPEX-driven industry with national interests and high barriers to entry, startups’ opportunities have usually been in B2B – and still are. 70,2% of digital energy startups founded after 2010 within SaaS, marketplace and ecommerce verticals are solely B2B startups.

The tide is turning, however. Driven by digitization, the products are in increasing amounts brought to the consumer, and investors are taking note: contrary to the existing industry composition, 8 out of the 10 largest rounds of 2020 and 2021 went to B2C firms.

Let’s put these two together – who sells what to who?

The vast majority of SaaS players, 90,5%, are selling to businesses, meaning that the sold software are mostly industry-level tools. Marketplace & ecommerce, on the other hand, have a customer mix very different to their overall industry with 50,9% of B2C businesses. On industry level it’s a minority, but a significant one – the biggest funding rounds of 2020 and 2021 highlight the massive business potential in digital energy B2C.

WHAT’S HAPPENING NEXT?

Pro-sumers, extreme weather, and no silver bullets

“I can imagine that in the future, energy systems will be much more integrated, and the consumers will have larger flexibility in deciding which energy source they want to use, how much they pay for it, and perhaps supply it back to the system”, says Gradyent’s Huisman, and refers to the word pro-sumers, which describes an individual who both consumes and produces.

The ongoing climate crisis also puts new pressure on energy infra in the form of increased extreme weather phenomena: “We see great interest in our monitoring solutions from utilities who want to do more to prevent wildfires, and the topic is becoming more relevant in Europe as well,” says the satellite-based infrastructure monitoring startup LiveEO’s PR-manager Andreas Naujoks. “Just think of the fires we witnessed in Greece in the summer. Storms are becoming more frequent and severe, too, which means that the grid needs to be more resilient against these events.”

When moving towards the energy transition, there’s no panacea: “It is important to note that AI is a key ingredient, but many more are needed as well,” says Gradyent’s Huisman.

Vapola agrees: “As climate and digital energy tech are something where new solutions and answers are needed fast, we have to recognize that the current climate crisis is a systemic issue: there’s no silver bullet that would solve everything, but rather multiple actions on many fronts are needed – electrifying, optimizing, streamlining and forecasting,” Vapola sums.

“The world in the future will look very different from today, and energy tech is an utterly interesting place for a startup to be in right now: doing something that’s very significant to our planet.”

This article has been done in partnership with Helen Ventures.